TREND CHANGE

5 MILLION GERMANS WANT TO HANDLE BANKING AND INSURANCE ONLINE MORE OFTEN

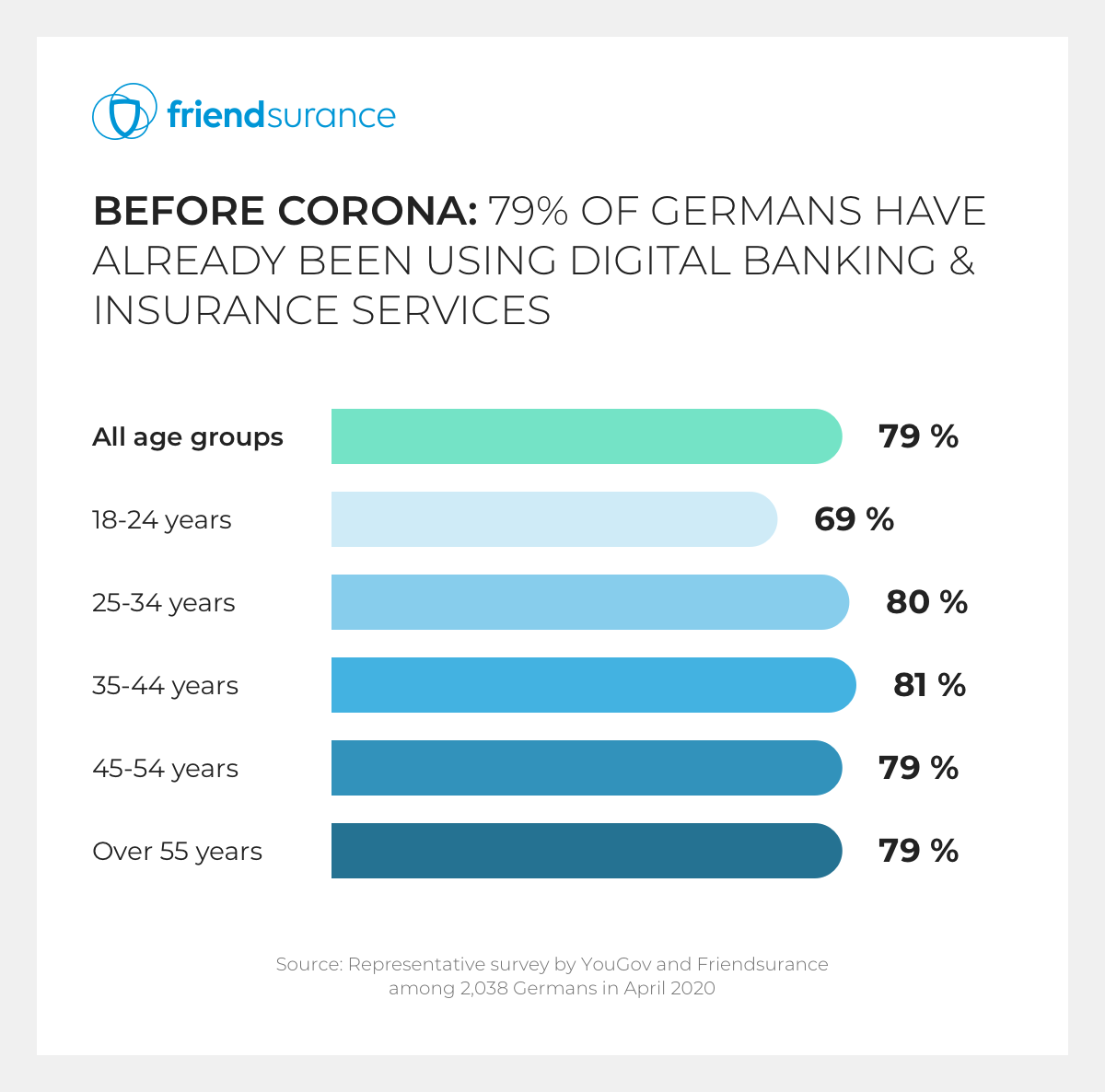

The majority of Germans (79%) has already been using digital services in banking and insurance before the crisis. At around 86%, the figure is particularly high among higher earners with a household net income of over EUR 2,500. The emergence of COVID-19 will push the market penetration even further. Being asked "Which of the following activities will you perform digitally/online more often after the end of the corona crisis than before the start?" 7% of the respondents answered that they want to increasingly manage their banking and insurance matters digitally in the future. This corresponds to about 5 million of the approximately 70 million adults in Germany.

NEW CONSUMER MODELS DEVELOPMENT

EVEN OLDER PEOPLE PLAN TO INCREASINGLY USE ONLINE OPTIONS FOR BANKING AND INSURANCE

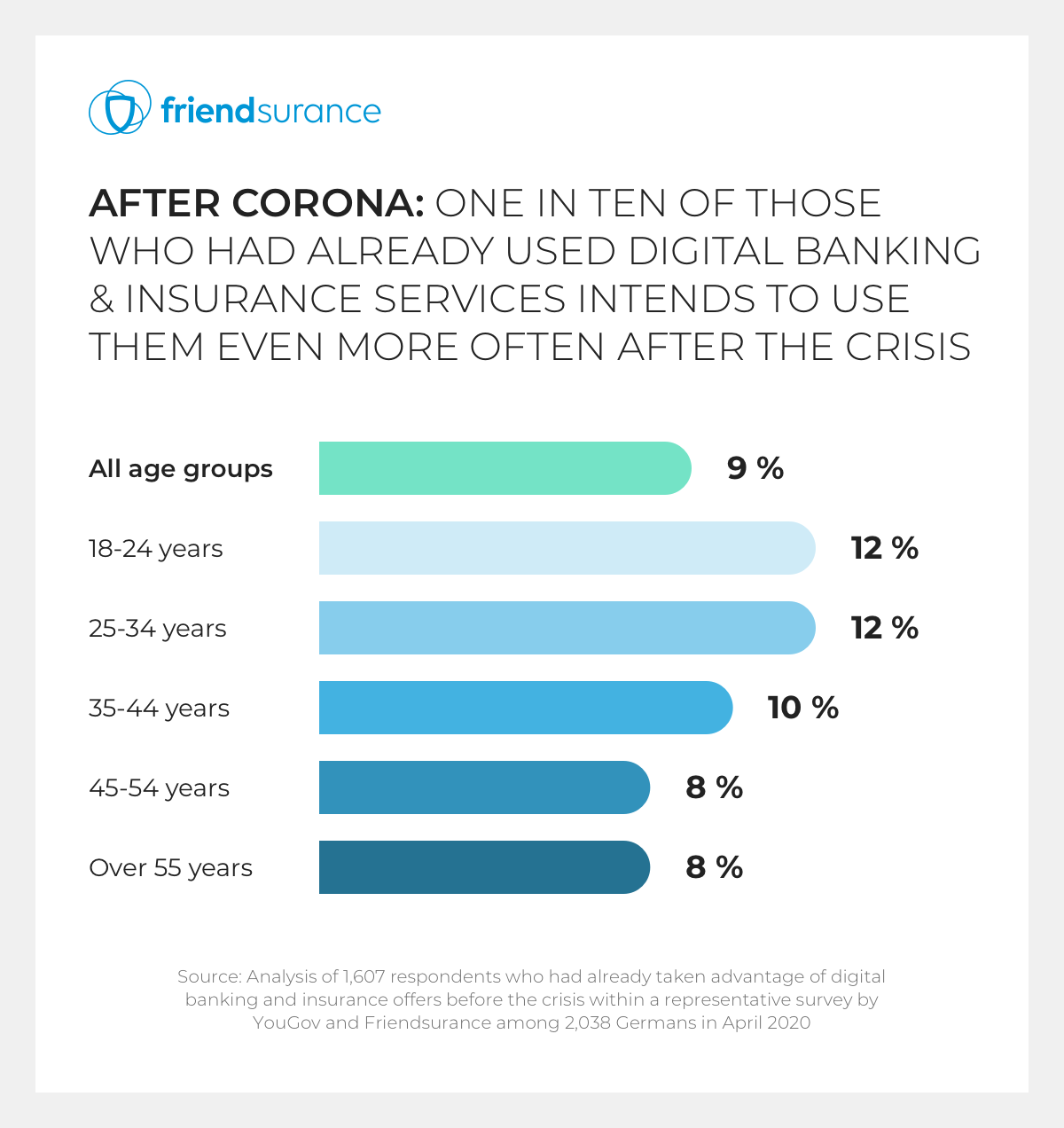

A separate analysis of the 1,607 respondents who had already taken advantage of digital banking and insurance offers before the crisis shows that every tenth of them (9%) intend to conduct banking and insurance business online even more frequently as a result of the corona crisis. This figure is highest among 18 to 34-year-olds with approx. 12%, followed by 35 to 44-year-olds with 10%. Surprising results: Not only young people, but also the 45-54 year olds and even the over 55 year olds who in other areas hardly show any digitalisation effects of Corona want to become more active in online banking and insurance with 8%.

COVID-19 SHAPES CUSTOMER BEHAVIOUR

ONLINE BANKING AS THE MODEL OF THE FUTURE

Part-time employees as target group with potential

The number of those who tried digital financial services before the pandemic is particularly high among those who work full-time at 86%. By contrast, the figure for those who work part-time is only 77%. Looking at the separate analysis of 1,607 respondents part-time workers are more likely to do more banking and insurance online in the future (12%) compared to 8% of full-time workers. The figures show that there is potential for a digital customer approach among the part-time employees. Given that every tenth German adult works part-time (7 million people) the mentioned 12% correspond to a target group of almost 1 million people.

Bancassurance will become more digital

In summary it can be said that COVID-19 will permanently shape customer behaviour. A digital approach to customers will gain importance across all age groups and thus also accelerate the digital transformation of the bancassurance sector. Bancassurance platforms such as ours which enable customers to manage and optimise their insurance contracts from their online banking are the model of the future. We are convinced that this applies not only to Germany but also to other European markets.

Friendsurance Co-Founder & Managing Director

Built Friendsurance up to be a game changer in the insurance industry and a strategic, technical partner of some of Europe's biggest banks and insurance providers for their digital customer solutions.