POTENTIAL ANALYSIS

DIGITAL BANCASSURANCE IN EUROPE

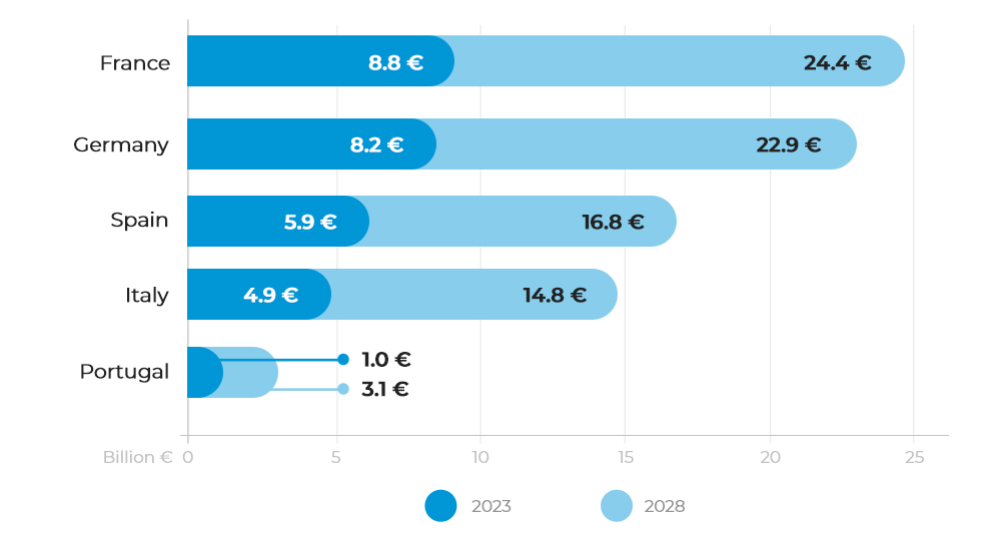

Digital Bancassurance keeps growing

Insurance premiums that are managed via

Digital Bancassurance channels are on a

growth trend: In the next ten years the

market volume is expected to grow to around

23 billion Euros in Germany alone.

Strong online service channels

Our experts predict the emergence of

billion Euro markets all across Europe.

Especially the integration of online offerings

gives banks and insurers the opportunity to

expand existing business models.

MARKET VOLUME

POTENTIAL OF DIGITAL BANCASSURANCE CAN BE MISJUDGED

Tim Kunde

Tim Kunde

MARKET PENETRATION

COSTUMER DEMAND FOR DIGITAL PRODUCTS INCREASES

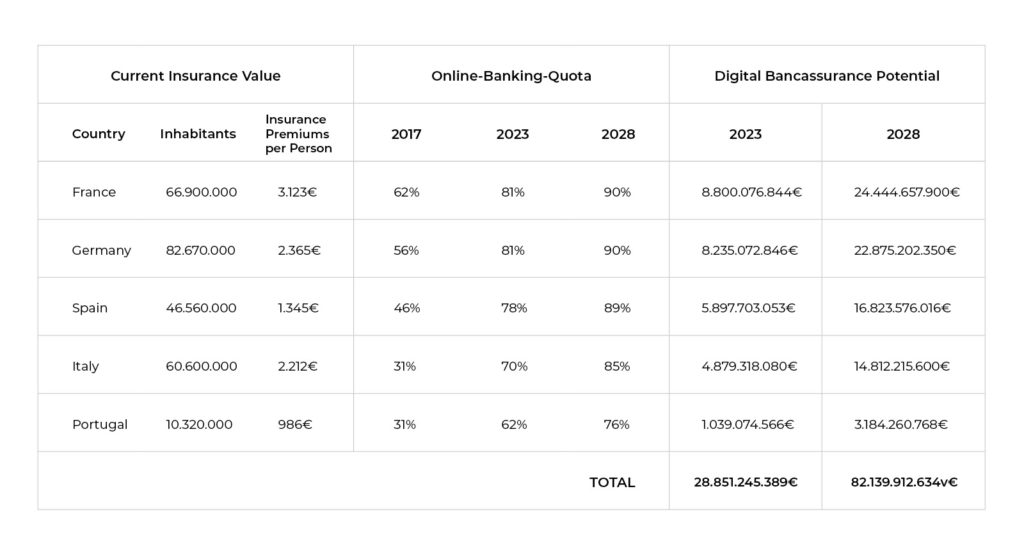

In a representative survey1 over half of the respondents said they were interested in managing their insurance contracts via their online banking account. Based on these results our experts predict that by 2023 at least 5% and by 2028 even 13% of existing contracts will be managed through digital bancassurance solutions.

According to a potential analysis by the insurance platform Friendsurance, digital bancassurance in Germany will reach a market volume of some 8 billion Euros in five years. By 2028, the Berlin insurance broker.... [more]

DIGITAL BANCASSURANCE IN EUROPE

EMERGENCE OF A BILLION-EURO MARKET

WHAT CAN WE DO FOR YOU?

CONTACT FORM

Do you have further questions or do you want

to learn more about our products? Please use

our contact form to get in touch:

Your contact at Friendsurance

Sebastian Langrehr, CSO

sebastian.langrehr@friendsurance.de

Newsletter