DACH-Countries

DIGITAL BANCASSURANCE IN A NUTSHELL

Some time ago, the editors of the German newsletter finanz-szene.de wrote: "People often ask us, why do you do so few articles about bancassurance”. To which they always reply, “because we know too little about it." That seems to be the case for many people. So we have tried to summarise the most important information about bancassurance in general, and digital bancassurance in particular.

RETROSPECTIVE

THE DEVELOPMENT OF TRADITIONAL BANCASSURANCE

Bancassurance means the combination of banking and insurance: Insurance products are sold through bank branches. In return, the banks get fees or commissions. Most banks have a long-term insurance partner and vice versa.

Bancassurance emerged in Europe in the 1970s and, in the 1980s and 1990s, spread throughout the world. In the early 2000s, there was a veritable bancassurance boom, triggered by the promotion of private retirement plans. In 2008, the failure of the merger between Allianz and Dresdner Bank, subsequent write-offs in the millions and the sale of Dresdner Bank to Commerzbank caused disillusionment in the bancassurance sector. At that time, Henri de Castries, long-time Chairman of Axa, prophesied "the death of bancassurance". Despite all this, bancassurance has established itself as a permanent distribution channel.

In many markets to this day, bancassurance is mostly a channel for selling life insurance products, which have higher average sale prices and commissions and tend to be more bank-related than most non-life products (e.g. life insurance policies covering a property investment). In Germany, bancassurance most recently had a share of around 19% of all new sales of life insurance products and around 5% of non-life insurance products.

POTENTIAL

BANCASSURANCE IS A MARKET WORTH BILLIONS

Already, the worldwide volume for premiums in the bancassurance industry is 648 billion euros a year. And the bancassurance channel is rapidly growing: According to a McKinsey analysis of 27 markets, bancassurance has seen a worldwide premium growth rate of 3.6% per year in life insurance and 5.3% in non-life from 2012 to 2019.

Tim Kunde

KEY DRIVERS

WHY IT IS CRUCIAL FOR BANCASSURANCE TO GO DIGITAL

Customer requirements are changing

Banks and insurance companies are facing shifting customer preferences: Fewer and fewer customers are willing to visit bank branches – not to mention the decreasing willingness to meet with insurance brokers and agents. According to a survey by Bitkom from 2019, one third of German online banking users (31%) conduct their banking transactions exclusively online and never visit a bank branch.

Instead, customers expect solutions that allow them to manage their financial affairs conveniently and efficiently. But the available online offers – forcing customers to log into different portals where they can only view a small part of their finances at a time – are not providing a satisfying customer experience. A representative survey by YouGov from 2018 showed that a majority of Germans (52%) would like to manage their insurance contracts directly via their online banking.

Germans interested to manage their insurance contracts via online banking

The Corona pandemic has accelerated customers' preferences towards conducting their business online. Even before the crisis, 79% of Germans used digital services in the banking and insurance sectors. Additionally, a YouGov survey conducted in April 2020 found that 10% now plan to make even greater use of online banking and insurance services beyond the end of the pandemic. A McKinsey survey in May 2020 comes to a similar conclusion: 14% of European customers believe they will increase their usage of online and mobile banking, even if pandemic-related lockdowns and social distancing decrease. Given these figures, it is all the more important for banks and insurers to develop integrated digital platform solutions.

Uta Niendorf

Banks and insurers are experiencing increasing pressure on earnings

Banks and insurers face complex challenges: Banks are confronted with declining earnings in this ongoing low or zero interest rate phase. In addition, they are threatened by declines in financial deposits and high credit defaults as a result of the Corona pandemic. In the insurance industry, on the other hand, even if pandemic-induced claims are limited, many large insurers have seen their profits decrease significantly in the first half of 2020. In addition, new business is decreasing due to the economic downturn and the lower incomes of private households – especially in life insurance.

Against this backdrop, banks and insurers increasingly find themselves under pressure to develop new sources of income and retain their customers. Digital bancassurance is an obvious strategy to increase commission income through the sale of insurance policies and, at the same time, to offer customers meaningful, digital services.

PSD2 enables data exchange and platform-based collaboration

Insurers have always needed data to assess risks and insure their customers. Until now, insurers have only been acquainted with a small part of their customers' lives. They are not relevant in customers’ day-to-day life and lack in-depth data on their needs and usage behaviour. Banks, on the other hand, are both highly relevant in everyday life (the customer contact frequency of online banking comes to approx. 30 interactions per month which is about ten times higher than in the insurance sector), and they have more access to customer data. But the sharing of customer data between banks and insurers has in many cases been restricted so far.

Recently, the regulatory framework has changed: The EU payment directive PSD2 dissolves the monopoly of banks on access to account data. Thanks to PSD2, insurers and other third-party providers are now able to access account bank data via standardised interfaces (APIs) if the customer authorises them to do so.

PSD2 ENABLED

WIN-WIN-WIN

FOR CUSTOMERS, INSURANCES & BANKS

Intelligent algorithms and machine learning are used to extract information from bank account transactions: On the one hand, insurance-relevant information such as the name of the insurance company and the insurance policy number can be obtained from account movements and displayed in a digital insurance overview. This is very convenient for customers: they do not need to have their insurance documents at hand but can have them transferred automatically. On the other hand, important life events can be identified, and meaningful adjustments of the insurance coverage can be suggested. If, for example, child benefit is suddenly transferred to a customer's bank account, the insurer can ask whether there has been a family addition and, if so, trigger a consultation about which existing insurance policies need to be adapted and which additional insurance policies might be useful.

Iris Kremers

When insurers and banks connect their IT systems and link their platforms, they not only have an enormous amount of data at their disposal, they can also create a seamless omnichannel customer experience.

Simon Nicholas

Solution: Cooperations with digital bancassurance experts

In view of these three developments, banks and insurers are in urgent need of digital bancassurance solutions. But they are faced with the problem that developing their own bancassurance platform is very time-consuming and costly. Therefore, it might make sense to cooperate with insurtech companies that have the technology, the digital know-how and the regulatory possibilities to develop and implement such solutions in a short period of time and at reasonable cost.

The Capgemini's "World Insurance Report", drawn from more than 150 insurance industry executives and 8,000 insurance customers from a total of 32 countries, also comes to the conclusion that established insurers will be successful if they cooperate with mature insurtech companies to develop innovative solutions and use data from open API ecosystems to better anticipate when customers need a new product.

No wonder then, that there are now numerous cooperations in the bancassurance sector involving two, often even three partners: The insurer as product provider, the bank as distribution channel and often a digital provider as well, who provides the technical solution.

Florian Nadler

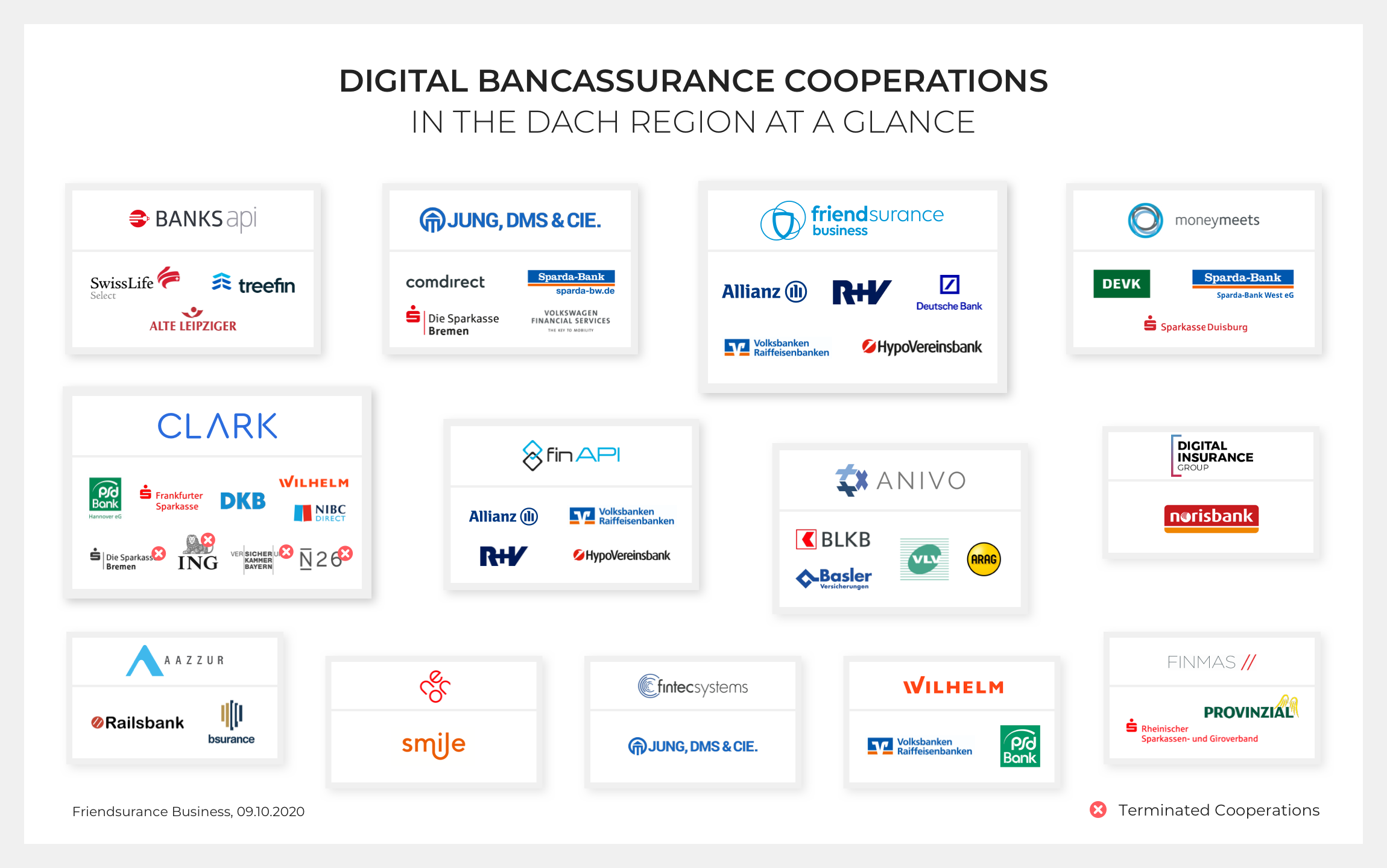

Some insurtechs offer white-label platforms, others offer dedicated, tailor-made solutions. But which insurtech actually cooperates with which banks and insurance companies in the DACH region?

* Translated from German

- https://finanz-szene.de/news/28-11-19-deutsche-bank-bancassurance-nordlb-comdirect

- https://www.gdv.de/de/themen/news/stabile-vertriebsstrukturen-50098

- https://www.mckinsey.com/industries/financial-services/our-insights/bancassurance-its-time-to-go-digital

- https://www.mckinsey.com/industries/financial-services/our-insights/european-bancassurance-impact-of-covid-19-and-the-next-normal

- https://www.bitkom.org/Presse/Presseinformation/Beim-Online-Banking-sind-nur-noch-Senioren-zurueckhaltend

- https://www.friendsurance.de/cms/pressemitteilung/Friendsurance-Pressemitteilung-Digitale%20Bancassurance%20Umfrage_20180828.pdf

- https://www.linkedin.com/pulse/after-corona-germans-become-more-digital-banking-insurance-tim-kunde

- https://www.mckinsey.com/industries/financial-services/our-insights/european-bancassurance-impact-of-covid-19-and-the-next-normal#

- https://www.q-perior.com/blog/bancassurance-loesung-der-richtige-schritt-zur-digitalen-und-integrierten-beratung

- https://www.msg-life.com/blog/rethinking-insurance/das-digitale-potential-von-bancassurance

- https://www.linkedin.com/pulse/hdi-bancassurance-setzt-auf-digitale-technologien-iris-kremers/

- https://home.kpmg/im/en/home/insights/2019/08/bringing-bancassurance-into-the-digital-era-fs.html

- https://www.capgemini.com/de-de/news/world-insurance-report-2020

- https://versicherungswirtschaft-heute.de/politik-und-regulierung/2020-07-13/gelingt-den-insurtechs-der-iphone-effekt-fuer-die-versicherungsbranche